The financial technology (fintech) sector is undergoing rapid transformation. At the center of this evolution are two game-changing technologies—Artificial Intelligence (AI) and Machine Learning (ML). These tools are no longer experimental; they are foundational. From fraud detection to investment planning, AI and ML have become essential to delivering smarter, faster, and more secure financial services.

Modern fintech apps deal with massive volumes of data. Users expect instant responses, personalized insights, and iron-clad security. Meeting these expectations manually is nearly impossible. That’s where AI and ML step in. They allow systems to learn from patterns, make predictions, and improve over time without direct human input. This enables companies to automate tasks, reduce errors, and better understand user behavior.

Whether you’re a startup building a finance app or an established company upgrading legacy systems, understanding how AI and ML fit into fintech is key to staying ahead of the curve. In this guide, we’ll explore the main roles of these technologies in today’s fintech landscape, their benefits, challenges, and the future they are shaping.

What Makes AI and ML Crucial in Fintech Today?

AI and ML have become core components of fintech because they allow companies to process vast amounts of financial data and extract meaningful, real-time insights. Unlike traditional software that relies on static rules, AI systems evolve by learning from past data and user behavior. This makes them uniquely equipped to handle dynamic, fast-paced environments like online finance, digital banking, and cryptocurrency trading.

Fintech apps deal with diverse challenges—fraud, high user expectations, regulatory requirements, and intense competition. AI and ML offer solutions that address all these areas simultaneously. They allow financial applications to do the following:

- Automate decision-making: AI helps apps make instant credit decisions, detect fraud, or suggest investments without waiting for human input.

- Deliver hyper-personalization: ML algorithms learn each user’s habits and tailor the app experience accordingly—improving satisfaction and retention.

- Improve scalability: These technologies handle millions of transactions or users simultaneously with consistent accuracy and performance.

- Enhance security: By analyzing historical data and detecting outliers, AI systems identify risks faster than manual monitoring ever could.

AI and ML are not just helpful—they’re strategic. They give fintech startups and enterprises a competitive edge by enabling faster innovation and reducing operational costs. As more companies digitize their services, the ability to deploy intelligent automation and predictive analytics becomes a must-have, not a nice-to-have.

Fraud Detection & Security

One of the most critical areas where AI and ML are making a profound impact is fraud detection. Financial fraud has become increasingly sophisticated, and traditional rule-based systems often fail to keep up with evolving threats. Machine Learning, however, offers a dynamic solution by learning from historical data and detecting subtle patterns that may indicate fraudulent behavior.

These intelligent systems monitor transaction data in real time, identify anomalies, and flag suspicious activities almost instantly. For example, if a user logs in from a new location or initiates an unusually large transfer, the system can trigger a warning or even block the transaction until verified.

- Real-time fraud alerts: AI systems analyze millions of transactions per second, enabling financial apps to detect and respond to potential threats within moments.

- Behavioral pattern analysis: ML models study user behavior over time—like spending habits, device usage, and login timing—to recognize abnormal actions that could signal fraud.

- Reduced false positives: Unlike static systems that might flag legitimate transactions, AI becomes more accurate over time, minimizing user disruptions.

- Adaptive learning: As fraud techniques evolve, ML algorithms adapt by updating their models based on new fraud trends, making the system increasingly robust.

By integrating AI-powered fraud detection into fintech applications, companies can protect both themselves and their users. It builds trust, ensures compliance with financial regulations, and minimizes financial losses from unauthorized activities.

Credit Scoring & Risk Assessment

Traditional credit scoring relies heavily on historical financial records and credit bureau data. However, this method can overlook individuals who have limited credit histories or unconventional income sources. AI and ML change the game by introducing more inclusive and flexible credit assessment techniques that draw from a wider set of data points.

Modern fintech apps powered by ML can analyze alternative data such as payment history for rent, utilities, mobile phone usage, or even social behavior patterns to determine a person’s creditworthiness. This broadens access to financial services and makes lending decisions more accurate.

- Alternative data analysis: AI models consider non-traditional sources like online purchases, bill payments, and employment records to form a more complete risk profile.

- Faster loan approvals: Automated systems analyze applications in real time, reducing waiting periods for users.

- Dynamic credit models: ML models continuously update risk assessments based on new data, helping lenders stay ahead of emerging risks.

- Reduced human bias: AI uses data-driven logic, lowering the risk of discrimination in lending decisions.

By integrating AI-driven credit scoring, fintech companies can extend credit more responsibly and inclusively. This not only improves business outcomes but also opens up access to financial resources for underserved populations.

Personalized Services

In today’s digital economy, users expect financial services tailored to their individual needs. AI and ML make this level of personalization possible by analyzing user behavior, spending habits, goals, and preferences. Fintech apps that integrate these technologies can offer smarter, more intuitive services that feel custom-built for each user.

Personalized experiences go far beyond product recommendations. They help users make better financial decisions through automated insights, timely nudges, and contextual suggestions. Whether it’s a custom savings plan or tailored investment advice, personalization adds real value to the user journey.

- Behavior-driven insights: ML tracks how users interact with the app and recommends actions based on their financial patterns.

- Smart financial planning: AI can suggest personalized budgets, investment opportunities, and savings goals aligned with a user’s income and spending.

- Dynamic content: Interfaces update in real time to reflect relevant content, offers, or alerts tailored to the individual user.

- Improved engagement: Personalized features make users feel understood, leading to increased app usage and loyalty.

By delivering a more personal experience, fintech apps can stand out in a crowded market and build long-term relationships with their users. AI and ML enable this through continuous learning and adaptation, ensuring the app evolves with the user’s needs.

Customer Support Automation

Customer support is a vital part of any fintech platform, but offering 24/7 assistance with a human-only team can be expensive and slow. That’s where AI-powered customer service tools, like chatbots and virtual assistants, come in. These tools can handle a wide range of user queries instantly and with consistent accuracy.

Thanks to Natural Language Processing (NLP), AI systems understand user intent even when questions are asked in everyday language. They can resolve issues related to payments, account access, KYC verification, and more—without human intervention.

- 24/7 instant support: AI chatbots can answer customer questions at any time of day, reducing wait times significantly.

- Efficient issue routing: If the query is complex, the system automatically escalates it to a human agent with all relevant context.

- Learning from past interactions: ML-based systems improve over time by analyzing user feedback and support history.

- Lower operational costs: Automating frequent support tasks reduces the need for large customer service teams.

Fintech companies using AI for support see higher customer satisfaction and reduced churn. It ensures that users get the help they need—faster, smarter, and more conveniently—making support a strength rather than a bottleneck.

Automation & Efficiency

One of the most powerful advantages of using AI and ML in fintech is the ability to automate repetitive and time-consuming tasks. From back-office operations to customer onboarding, these technologies streamline workflows, reduce errors, and help companies scale with fewer resources.

Manual data entry, compliance checks, transaction processing, and document verification can all be handled by intelligent systems. This allows employees to focus on more strategic, creative, or customer-focused activities—improving productivity across the organization.

- Process automation: AI bots can handle routine financial tasks like data entry, transaction validation, and reporting with speed and accuracy.

- Workflow optimization: ML identifies inefficiencies in current processes and suggests improvements based on performance data.

- Error reduction: By automating rule-based operations, the chance of human error is drastically minimized.

- Faster onboarding: AI accelerates KYC (Know Your Customer) and identity verification, making it quicker for users to start using the app.

Efficiency isn’t just about doing things faster—it’s about doing them smarter. Fintech apps that leverage automation save time, reduce costs, and ensure greater consistency across operations. This ultimately leads to better service delivery and stronger user trust.

AI in Investment Advisory and Robo-Advisors

AI and ML are transforming how people manage their investments. Traditional financial advisors are being complemented—or even replaced—by robo-advisors: automated platforms that provide data-driven investment guidance. These systems use algorithms to assess a user’s financial goals, risk appetite, and market trends to create tailored investment strategies.

Unlike human advisors, robo-advisors can analyze vast datasets in seconds, rebalance portfolios automatically, and remain emotion-free during market volatility. This makes them an ideal solution for both beginner and experienced investors looking for efficient, low-cost financial planning.

- Personalized portfolio management: AI algorithms customize investment plans based on each user’s risk tolerance, goals, and financial behavior.

- Automated rebalancing: Robo-advisors monitor market movements and adjust asset allocations without user intervention to keep the strategy aligned.

- Lower fees: Because these platforms require minimal human involvement, they offer services at a fraction of the cost of traditional advisors.

- Accessibility: Even users with small investment amounts can benefit from AI-powered advisory, making wealth management more inclusive.

These smart advisory tools are redefining the future of investing. By combining financial algorithms with real-time market data, they offer consistent, unbiased, and highly scalable investment support through fintech apps.

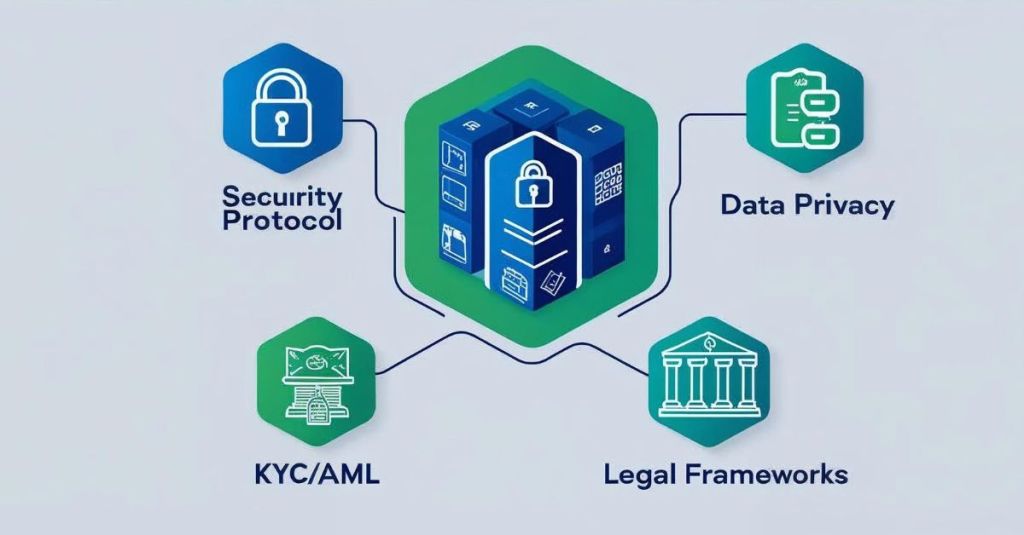

Challenges of Implementing AI in Fintech

While the benefits of AI and ML in fintech are impressive, the path to successful implementation is not without obstacles. These technologies come with complexities that fintech companies must navigate carefully, especially in highly regulated financial environments.

From data quality concerns to regulatory risks, several challenges can slow or complicate the deployment of intelligent systems. Understanding these roadblocks is essential for planning a responsible, scalable AI strategy in fintech apps.

- Data privacy and compliance: Fintech apps deal with sensitive financial information. Meeting regulations like GDPR, CCPA, and PCI-DSS while using AI requires strict data handling protocols.

- Model transparency: ML models often operate as “black boxes,” making it difficult to explain how decisions are made—especially important when dealing with credit approvals or fraud cases.

- Bias in algorithms: If the data used to train AI is biased or incomplete, the outcomes may be unfair or discriminatory—posing ethical and legal risks.

- Talent and cost barriers: Building and maintaining AI infrastructure requires skilled professionals and significant investment, which can be challenging for smaller fintech startups.

Overcoming these challenges requires a thoughtful mix of ethical AI practices, ongoing monitoring, and collaboration with legal and technical teams. With the right safeguards in place, fintech companies can confidently embrace AI while minimizing risks.

Future of AI and ML in Fintech

The future of AI and ML in fintech is incredibly promising. As these technologies become more advanced, their role in financial services will continue to grow—reshaping how people bank, invest, save, and interact with money. Fintech companies will increasingly rely on intelligent automation, predictive analytics, and personalized experiences to stay ahead of user expectations and competitors.

In the years ahead, we can expect to see fintech apps moving from reactive systems to fully proactive financial advisors. AI will not just assist but anticipate user needs, offering real-time financial coaching and risk alerts before issues arise.

- Hyper-personalized banking: Fintech apps will deliver real-time, personalized financial insights based on individual life events, income changes, and goals.

- AI-led financial planning: Intelligent assistants may replace human advisors entirely, using real-time data to build and adjust comprehensive financial plans.

- Voice and conversational AI: More apps will integrate voice commands and natural language conversations to make managing finances easier and more intuitive.

- Improved compliance and auditing: AI will be used to monitor regulatory compliance in real-time, reducing risk and manual oversight.

Ultimately, the future of fintech is smart, fast, and personalized. Companies that invest in responsible AI development today will be better positioned to deliver the financial tools of tomorrow—secure, adaptive, and user-centric.

Conclusion

Artificial Intelligence and Machine Learning are not just enhancements to fintech apps—they’re foundational to their innovation, scalability, and competitiveness. From fraud detection and personalized services to automated investment advice and efficient operations, AI-driven technologies are unlocking new possibilities across every layer of financial services.

However, implementing AI comes with challenges such as data privacy, algorithm bias, and high development costs. With a balanced, ethical, and strategic approach, fintech companies can overcome these hurdles and harness the full potential of intelligent systems.

If you’re looking to build future-ready financial solutions powered by AI, partnering with experienced Fintech App Development Companies can help bring your vision to life with precision and scalability.